QUEZON CITY, Philippines – A major constraint to the productivity of farmers is their lack of access to sufficient support and credit for investing in crops, technology, or security amidst risks and in the face of shocks. Though credit programs are available, agricultural loans are risky and unpredictable owing to higher transaction costs of farm credit, unaffordability of the loans, inflexibility of payment schemes, low capital returns in agriculture, and swaying environmental and market factors.

With the support of Fair Finance Asia through Initiatives for Dialogue and Empowerment through Alternative Legal Services (IDEALS), case studies were conducted in Bangladesh, India, Indonesia, Nepal, and the Philippines, to analyze the relevance, appropriateness, accessibility, and usefulness of selected government credit programs for smallholders; and to propose recommendations to improve smallholder’s access to and utilization of selected public agricultural credit programs.

The regional summary of the findings and recommendations from these case studies were disseminated during a regional learning event conducted on 6 December 2021.

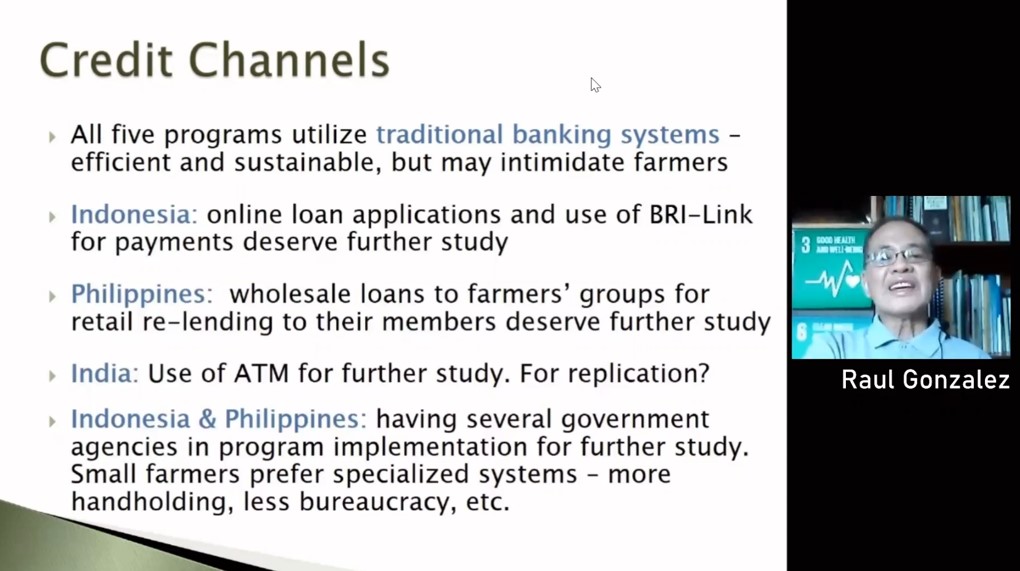

Mr. Raul Gonzalez provides the summary of the five country case studies

According to the regional summary, the following are the key factors to improve overall implementation of public agricultural credit programs:

Civil society organizations were the predominant audience of the event. During the program, representatives from government agencies implementing the agricultural credit programs in the five countries were able to share their experiences and lessons learned.

Invited panelists also shared their reflections and recommendations for implementing public agricultural credit programs that are responsive to farmers’ needs. The panel was composed of Mr. Tarmo from a farmers’ organization in Indonesia, Mr. Ravi Khetarpal from the Asia-Pacific Association of Agricultural Research Institution (APAARI), and Mr. Abdelkarim Sma from the International Fund for Agricultural Development (IFAD).

Government agency representatives and panelists share experiences and reflections on agricultural credit programs

This learning event was co-organized by the Asian NGO Coalition for Agrarian Reform and Rural Development (ANGOC), the Land Watch Asia (LWA) Campaign, Association for Land Reform and Development (ALRD), Association of Voluntary Agencies for Rural Development (AVARD), Bina Desa, and Community Self Reliance Centre (CSRC).

Land Watch Asia partners who worked on the case studies

The full report and case studies may be downloaded here